Reflation Prevails!

Os ativos de risco estão iniciando a semana na mesma toada em que encerram o mês passado, ou seja, com a abertura das taxas de juros nos EUA dando sustentação ao USD no mundo. As bolsas apresentam leve elevação, com as commodities sem tendências definidas, mas com leve viés negativo esta manhã.

Continuo vendo espaço para a continuidade destes movimentos. Acredito que o “Reflation” seja o cenário mais provável para o curto-prazo, e que só se tornaria “Risk-Off” na eventualidade de uma aceleração muito mais acentuada da abertura das taxas de juros, ou na concretização de algum “risco de cauda” (como conflito militar junto a Coréia do Norte, ou similar) que não esteja totalmente mapeado pelos investidores.

Os dados recentes apontam na direção deste panorama descrito acima. Por exemplo, as Exportações da Coréia do Sul, mostraram nova aceleração em setembro, reforçando um cenário de solidez da corrente de comércio global. No Japão, o Takan – um dos indicadores de confiança mais importantes do país, trimestral e coletado pelo BoJ – apresentou elevação acima das expectativas, mostrando um ambiente de recuperação da economia japonesa.

Brasil – O cenário continua sem novidades relevantes. A mídia continua dando atenção a ruídos pontuais. A pesquisa presidencial do Datafolha pode trazer debate no mercado, mas acho difícil que afeta a dinâmica de maneira persistente nesta etapa do debate político. Ainda gosto de posições favoráveis aos ativos locais, mas vejo espaço para mais movimentos de acomodação no curto-prazo. Acho prudente adotar postura mais tática no atual pano de fundo global, administrando o tamanho e os instrumentos das posições.

Espanha – O “Referendo” de independência da Catalunha ocorreu de forma truncada, com forte repressão do Governo Central da Espanha. O turnover foi baixo, com menos de 40% de votos. Segundo o Governo Catalão, os votos favoráveis a independência da região ultrapassaram os 90%. Agora, existe uma amplitude de possibilidade para o caminho que será seguido pela região. Acredito que o problema vivido pela Espanha é grave, e não pode ser deixado de lado. Por ora, contudo, é apenas uma questão local, que não deveria gerar contágio ao resto do mundo. Segundo o Citibank:

· Unilateral Declaration of Independence? – The Catalan Parliament will hold a referendum-focused session on Tuesday. According to the ‘referendum law’ passed in the Catalan Parliament, a YES vote (no participation threshold) is enough for passing a declaration of independence and kick-start a gradual process to exit Spain (including drafting a constitution and build the new institutions). The law, however, calls for a period of negotiations with Madrid and the international community, implying that a move to declare independence would not have immediate effects in the legal relationship between the region and the rest of Spain.

· What Next? – We expect the regional government to try to capitalize on recent events and call snap regional elections. As in the 2015 regional election, the next ballot is likely to be framed as a plebiscite vote over independence, with the ruling ‘Together For Yes’ coalition likely to stick together. Recent polls suggest ‘Together For Yes’ will probably fail to reach a majority and may need support from either the far-left CUP or the leftwing Podemos to remain in power. We expect a pro-independence government to eventually be formed with a secessionist agenda. Attempts to hold a new referendum are likely to follow.

· But What If All Goes Wrong? – An alternative scenario would feature the Catalan government pressing ahead by declaring independence in coming days. The move would be challenged immediately at the Constitutional Court, which almost certainly would rule against it. If the Catalan government ignores the ruling, we expect Madrid to trigger article 155 of the Constitution to strip out Catalonia’s autonomy and to call for regional elections. We see the risk that this could trigger a civil rebellion, with possible wide disruptions and violent confrontations. A move by the regional police force to ally with the pro-independence parties could significantly escalate the situation. We assign a non-negligible probability to this scenario.

Posição Técnica – A posição do USD mostra condições para que o movimento de fortalecimento da moeda norte americana continue, pelo menos no curto-prazo. Segundo o JPM:

- Despite positive US cyclical developments, the trend in USD and JPY funding into high beta and policy normalizing reserve currencies (CAD, EUR, GBP) resumed significantly as reflected in the IMM data in the week to Tuesday 26 Sep. Net notional USD shorts extended to a new cycle low of $-21.1bn, now basically matching the Jan’13 cycle low (-21.5). Meanwhile JPY shorts extended to JPY-890bn. The main beneficiaries were EUR (longs jumped to EUR11bn from 7.8bn the week prior), CAD (longs to CAD7.5bn, a fresh cycle high from, 5.9bn), and GBP. Net GBP contracts are now long (to the tune of GBP300m notional) for the first time since Nov’15.

- New highs in overall EM FX overweight positioning in the latest monthly JPM survey (Figure 4), last taken 18-20 September. The increase in overall overweights from August to September now exceeds the range highs seen during the 2010-1H13 era of Fed QE and in fact is a historical series high. The improvement in positioning was quite broad based, with 16 of 26 EM currencies seeing material positioning improvement, and only 3 seeing material positioning deterioration. Timely and full details of EM FX and the overall fixed income positioning survey are available to participating clients (see details here).

- The EM positioning remains mostly pro-carry, although there are idiosyncratic exceptions. Perhaps in the current environment it is not surprising that the six most relatively underweight currencies are the lowest yielding EM Asia and EMEA EM currencies (on an absolute, rather than z-score basis, so TWD, SGD, THB, KRW, RON, and ILS), while the most overweight are high yielding ones from all three regions (EGP, INR, IDR, TRY, MXN, RUB). But then there are idiosyncratic exceptions. The seventh most overweight EM currency is MYR despite being among the lowest tier in carry, probably on structural undervaluation rationale. Meanwhile, the seventh most underweight EM currency is ZAR despite being a relatively high carry currency.

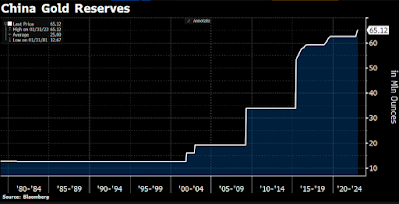

China – Os sell-sides reagiram de maneira positiva ao anuncio do corte de compulsório no país, que comentei neste fórum no final de semana. Segundo a média do mercado, o corte representa uma liberação razoável de liquidez na economia, e deveria dar sustentação ao crescimento nos próximos meses. Segundo a Goldman Sachs:

|

|

|

|

|

Comentários

Postar um comentário