Sem novidades. Uma visão interessante do cenário.

Os ativos de risco apresentaram alguma recuperação ao longo do dia, após forte pressão negativa adicional ao longo de toda a tarde de quinta-feira e no fechamento das bolsas dos EUA. Já comentei amplamente sobre o cenário corrente nos últimos dias. não vejo motivos para me estender neste tema (vejam os comentários aqui: https://mercadosglobais.blogspot.com.br/).

Na China, o CPI e o PPI ficaram dentro das expectativas do mercado, mostrando um cenário estável de inflação.

No Brasil, não há novidades locais relevantes.

A agenda do dia será esvaziada. Assim, os ativos de risco devem continuar a mercê de fluxos pontuais e questões técnicas.

Abaixo, copio o comentário dos analistas de FX do Morgan Stanley. Eles costumam apresentar panoramas muito acertados, com uma visão sóbria sobre o cenário econômico:

Bonds and equities falling simultaneously suggest that the current market correction is down to a liquidity squeeze. The best capital market environment develops when there is sufficient free liquidity standing ready to drive asset valuations higher. Over recent weeks, it appears that increasing signs of global economic expansion have resulted in financial capital being transferred to the real side of the economy. Rising inflation, with US breakevens reaching the FED target, has pushed rate expectations higher. The USD failing to correct higher despite USD supportive interest rate and yield differentials did not help either, with the weakening of the USD pushing inflation higher.

Inflation, liquidity and volatility are all linked. Low inflation allows central banks to stay accommodative which is an important condition, keeping liquidity and capital markets supported. A second factor driving financial market conditions is net savings which are typically generated within surplus environments such as Japan, EMU and Asia. Paradoxically, a more balanced global economy, which sees current account surpluses coming down, has the potential to undermine capital markets. This risk intensifies when surpluses are falling quickly. Periods when Japan, EMU and Asia are exporting vast amounts of capital tend to work in favour of capital markets as cross border capital flows predominantly turn up within foreign financial markets. The contribution of EMU, Japan and Asia to global liquidity should not be underestimated. In this sense, recent good news out of Germany with the ‘Metall’ sector agreeing an effective 3.9% wage increase and Germany’s upcoming new government declaring the end of austerity may boost local domestic demand, but it will reduce its savings which will likely be exported into other markets.

Potential policy mistakes: With liquidity in retreat, volatility will have to establish new levels. Policy mistakes can add to volatility. The most prominent policy mistake was G4 central banks such as the FED not understanding liquidity dynamics coming from the ‘glut of Asian savings’ (2002-2007) which pushed funding costs and volatility too low for too long, allowing the misallocation of capital into sub-prime and other low quality assets. Now the glut of Asian savings has been replaced by an even bigger glut of savings coming out of EMU, Japan and Asia. Reducing these savings too fast, by pushing Europe into a demand boom, could have volatility and financial asset price consequences that central banks, once again, may not have on their radar.

Best trades: The countries which benefited from the glut of savings have seen their balance sheets move into extremes, now deploying high credit gaps and running high asset exposures. We therefore like to buy the EUR and JPY against currencies which benefited from the glut of savings and think there is room for double digit gains in such crosses. EUR longs against AUD, CAD, NZD and GBP are our best recommendation. EURUSD should bounce from levels above 1.2165. Turning EM credit neutral has been timely. EMBIG spreads widened 12bp yesterday and the EMBIG total return index fell 0.72%. In comparison, while EMBIG spreads sold off 17bp on Monday, the total return held up better at just -0.34% due to decline in UST yields. We have also seen large ETF HC ETF outflows of US$1.4bn in February which is over 50% of the US$2.2bn inflow in EM HC ETFs recorded in January.

Markets do talk and in this sense the reaction of GBP to the BOE’s hawkishness was remarkable. GBP was not able to hold its gains although the BOE's Carney did lay out a scenario to hike rates earlier and towards higher levels relative to what has been previously priced into the front end of the curve. Importantly, the UK may potentially be the most affected when international liquidity conditions tighten, with its high level of unsecured debt and its 4.6% GDP current account deficit. GBP/JPY rebounded to test its previous break lower level and reversed from there. GBP remains a sell at current levels.

FED Put: After listening to FED’s Dudley, some investors wonder if the FED has withdrawn its equity markets ‘put’. He said the economy is likely to continue to grow above its normal pace, calling the 10% equity market correction ‘small potatoes'. Esther George and John Williams all recently reinforced the idea the Fed is on course to hike three times this year. Koenig, a principal policy adviser who prepares the Dallas Fed Chief for FOMC meetings, also suggests that inflation is actually higher than the Commerce Department's current estimates, using an experimental forecasting model. Their latest "nowcast" for the personal consumption expenditures price index, the Fed's preferred gauge of consumer price levels, saw overall inflation in their series reaching 1.9% in September and November before retreating to 1.8% in December and 1.6% in January. China’s January inflation has come in line within expectations, seeing CPI easing from 1.8% in December to 1.5% and PPI growth declining from 4.9% to 4.3%. However, Exhibit 1 indicates it may be too early to gain reassurance from falling Chinese inflation rates. The impact of the rising TWI has diluted the impact of the falling PPI. Time lags considered, it seems that the ‘China price’ may still push US core inflation higher which is bad news for risky assets.

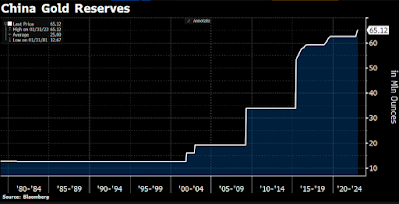

Watching China: China has an interest in keeping the global economy strong to progress with its balance sheet de-risking strategy. The 1987 stock crash showed that a sudden volatility event can undermine otherwise strong fundamentals. Now as markets focus on inflation and potential central bank tightening responses, keeping inflation rates low may be the best cure for risk appetite to rebound. Today, the PBoC has released nearly CNY2 trn in temporary liquidity. China switching from a strategy of RMB strength towards a more neutral approach may, via its impact on China import prices into the US, help to ease the inflation scare a bit. Unfortunately, the 10-year US breakeven rate has stayed elevated despite the recent capital market volatility which suggests that the equity market may have further near-term downside potential. The RTY has eased back again towards its 200-day MAV. A break of this level could bring a test of August lows into play implicit with a 7% further decline.

Comentários

Postar um comentário